DO YOU QUALIFY FOR AN IVA

No Commercial Pressure Find out whether proposing an IVA is in your best interests without being put under any pressure to make a decision.

Stops legal action An IVA forces creditors to stop any recovery action from being taken against you, removing the threat of any bailiff visits or you being made bankrupt.

Debt Forgiveness Your creditors will be legally obliged to write-off any outstanding balances still left unpaid at the end of your IVA, guaranteeing to leave you debt free.

Protects your home equity An IVA protects your equity because it stops your creditors from taking recovery action against you that could force you to sell your home.

Free Not For Profit Advice Have a free consultation with one of the specialist advisors and explore all your options and how they compare before you decide how you want to move forward.

Freezes interest and charges An IVA forces creditors to freeze all interest and stop late payment charges being added to the debts in the IVA, ensuring that your debts stop growing.

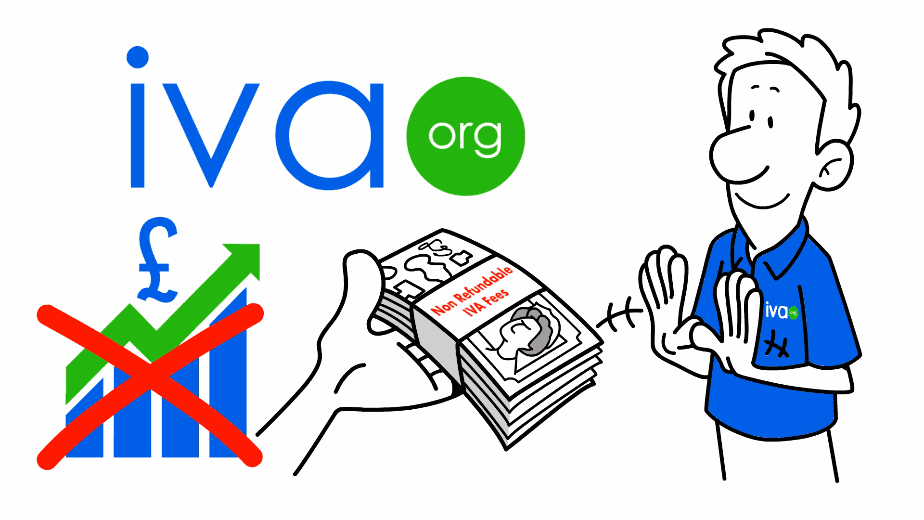

IVA failure protection pledge IVAorg’s unique social pledge protects you against the threat of losing thousands of pounds in IVA fees, in the event your IVA was to fail through no fault of your own.

All profits generated through our insolvency practice, or as a result of our IVA activities, are used to further our company’s social objectives, specifically to assist in the relief of poverty for people living in the UK.

This means that if you successfully complete your IVA using IVAorg CIC's services, you are also directly helping us to assist vulnerable members of your community who are also struggling to control their debts.

Are you struggling to keep up with your debt repayments each month?

An Individual Voluntary Arrangement, or IVA, can reduce the cost of your debt to a single, more affordable, monthly repayment.

It can provide you with legal protection from your creditors and has the power to stop CCJs and bailiff visits in their tracks.

It has a fixed repayment term, normally set to 5 years, after which any outstanding debt is legally written off - leaving you debt free.

An IVA is a powerful alternative to bankruptcy with the capacity to protect assets and incomes that might be otherwise vulnerable under the bankruptcy process.

For more information call us now and arrange a free and confidential consultation with one of our IVA specialists.

Talk to the not for profit IVA specialists now 0800 856 8569