IVAorg's Approach to IVAs

IVA Fees

All IVA providers charge fees for the work they do in preparing and administering an IVA. There are no exceptions, and IVA providers only differ in the amount they charged.

So, whenever an IVA is undertaken, someone will be expected to pay for it.

How IVA fees work

Creditors are given the opportunity to dictate the amount of fees being charged by the IVA provider before the IVA begins.

They do this by modifying any proposed fees they feel are excessive at the Creditors' Meeting.

Once the level of fees has been decided, an agreement is then made over when those fees can be drawn.

Creditors will normally allow the IVA provider to take their fees out of the money being paid into the IVA by the IVA customer.

It is currently normal practice for IVA providers to be allowed to take some of their IVA fees first, so they get paid faster at the start of the IVA, with less then being taken towards the end.

Unfortunately for creditors this reduces the amount of money they recover in the early stages of the IVA.

Successful Completion

When an IVA customer successfully completes their IVA having repaid all that was agreed, their outstanding debts are written off, leaving them debt free.

Which means that when an IVA completes successfully, it will be the creditors who pay the IVA fees, due to them sacrificing some of the IVA repayments and having to write off more of the original debt.

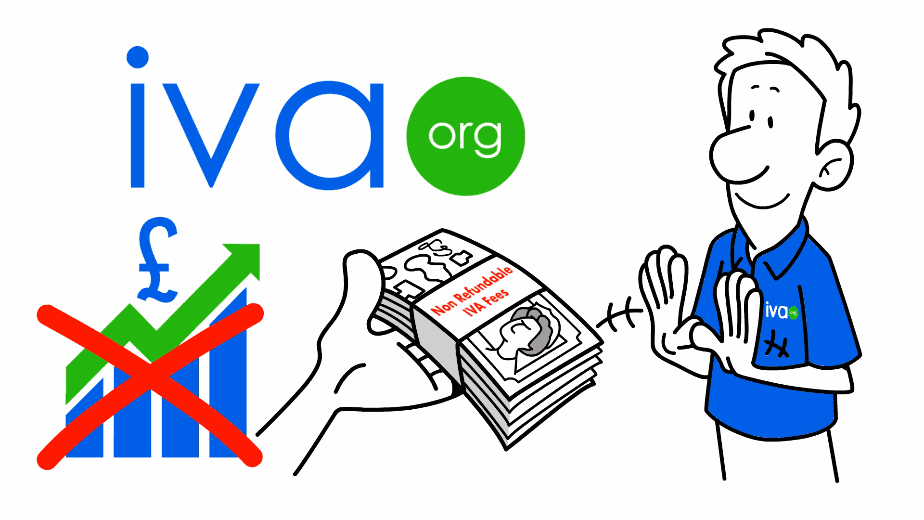

IVA Failures

But what happens if a customer can’t get to the end of their IVA because their circumstances change or they hit payment problems?

Who pays the fees when an IVA fails?

Current industry statistics show that 1 in every 4 IVAs fail

When an IVA fails, the IVA customer becomes responsible, once more, for all their original debt from before the IVA began.

For the reasons explained above, the IVA provider will have been allowed to deduct fees from the money they paid in to their IVA.

Unfortunately, this means that not all the money they have paid into the IVA will have been used to pay their debt.

Depending on how long the IVA has been running, it could mean that thousands of pounds in fees have been taken by the IVA provider.

This means that when an IVA fails, it's the IVA customer who is left to pay for the IVA fees.

Shockingly, current statistics tell us that 1 in every 4 IVA fail and most of those customers will end up paying thousands of pounds in IVA fees with little to show for it.

IVAorg’s Ethical Pledge

We are committed to improving outcomes for all those vulnerable individuals whose IVAs fail through no fault of their own, so we have a unique social ‘pledge’.

“Should your IVA fail to complete successfully through no fault of your own, we pledge the fees you’ve paid for our services will be used to reduce your debt to maximum effect, leaving you no worse off for having tried to complete an IVA that subsequently failed.”

Our pledge ensures that we, too, are invested in giving your IVA the very best chance of reaching a successful outcome.